Many employers will financially match the charitable contributions made by their employees. Matching gift programs allow you to double your impact while contributing to charitable organizations at a level that is financially comfortable for you.

Here’s How it Works:

1) Make a tax-deductible donation to the J Street Education Fund.

2) Check with your employer to see if they have a matching gift program.

3) Submit a request for a gift match through your employer. This is normally a quick and easy process!

You can find all the information and documentation you’ll need for this request below:

J Street Point of Contact:

Nick Shulevitz, Director of Development Operations

Phone Number: 202.448.1602

Email: [email protected]

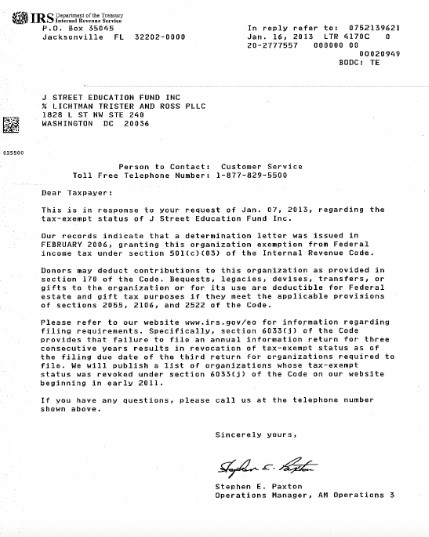

J Street Education Fund IRS Determination Letter:

Click here to download the 501(c)3 determination letter

4) If approved, your employer will match your donation. Employers usually match donations at a 1:1 ratio but some will match at a 2:1, 3:1 or even 4:1 ratio.

For additional questions about employer-matched donations, please reach out to Nick Shulevitz, Director of Development Operations, at 202.448.1602 or [email protected].